Its not an easy job to buy a house. Similarly, it is equally a painstaking task to determine the price of a house when you put it out in the market for sale. The price of a house is influenced by a wide range of economic factors that shape the real estate market. These factors are interconnected and can have a significant impact on the supply and demand dynamics, ultimately affecting the price levels.

Let’s explore some key economic factors that influence the price of a house.

Supply and Demand:

The fundamental principle of supply and demand plays a crucial role in determining house prices. When the demand for houses exceeds the available supply, prices tend to rise. Conversely, when the supply exceeds demand, prices may decline. Factors such as population growth, migration patterns, and housing market conditions affect the balance between supply and demand.

Interest Rates:

Interest rates set by central banks influence mortgage rates, which, in turn, affect housing affordability. Lower interest rates make borrowing cheaper, encouraging more people to enter the housing market and increasing demand. Higher interest rates can have the opposite effect, dampening demand and potentially leading to lower house prices.

Economic Growth and Employment:

The overall health of the economy and employment levels significantly impact the housing market. During periods of economic growth and low unemployment, individuals and families are more likely to have stable incomes and are better positioned to purchase homes. Strong economic conditions can drive up housing demand and contribute to rising prices.

Income Levels and Affordability:

The purchasing power of individuals is closely tied to their income levels. Higher incomes generally translate into greater affordability and the ability to pay higher prices for homes. Conversely, stagnant or declining incomes can limit purchasing power and put downward pressure on house prices.

Housing Market Regulations and Policies:

Government policies and regulations can influence the housing market and impact prices. For instance, zoning regulations, building codes, and restrictions on land use can affect the supply of housing. Additionally, government programs aimed at promoting affordable housing or providing incentives for homeownership can influence demand and affordability.

Consumer Confidence and Sentiment:

Consumer confidence and sentiment play a significant role in the housing market. When people feel optimistic about the economy and their financial situation, they are more likely to make long-term investments, such as purchasing a house. Positive consumer sentiment can contribute to increased demand and higher prices.

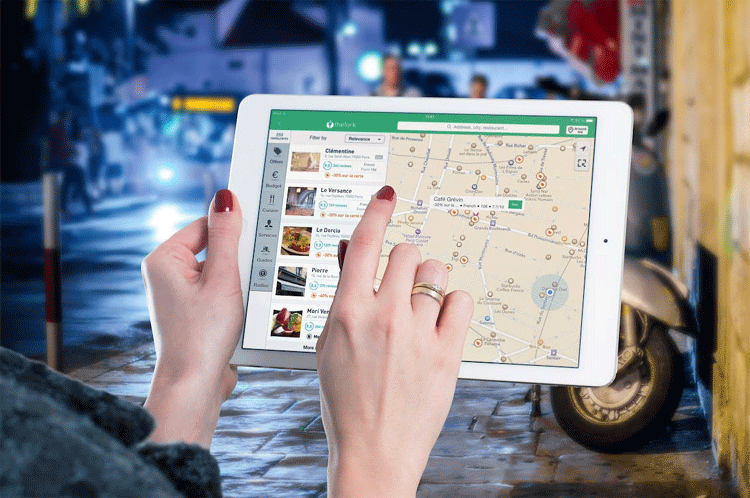

Location and Neighborhood Factors:

Location is a critical determinant of housing prices. Desirable neighborhoods with proximity to amenities like schools, parks, shopping centers, and transportation tend to command higher prices. Factors such as crime rates, quality of schools, and the overall livability of an area can also influence housing prices.

Market Speculation and Investor Activity:

The presence of real estate investors and market speculation can impact housing prices. Investors seeking to profit from rising prices may engage in speculative buying, driving up demand and prices. Conversely, investor pullbacks or selling in anticipation of price declines can have a cooling effect on the market.

Construction and Development Costs:

The cost of construction materials, labor, and land acquisition can influence the supply side of the housing market. Higher construction costs can reduce the supply of new homes, potentially leading to higher prices. Additionally, land scarcity and development restrictions can limit the availability of housing, impacting prices.

Wrapping Up

It’s important to note that these economic factors are not exhaustive, and the housing market can be influenced by various other factors specific to each local market. Additionally, the interplay between these factors can create complex dynamics that shape house prices. Monitoring and understanding these economic factors can provide insights into the current state and future trends of the real estate market.

Also Read: Smart Home Security Systems – Need Of Time