Pakistan continues to experience a downward trend toward growth as inflation continues to soar and makes new records in history. The country is undergoing one of the driest and most inflation-hit periods. Everything has gone out of hand, and the trend continues.

When we talk about inflation, everything is interlinked and revolving in a vicious cycle. But if we had to determine why the economy of Pakistan has deteriorated so fast in the past few months, a few reasons come to mind. The devaluation of the rupee against the dollar, hefty import prices, political instability, and sharp decline in the forex reserves.

If this was not enough, the government of Pakistan embarked on new taxes on the real estate market, which no one was actually prepared for.

So, in these trying times, is it wise to invest? Would it be wise to transfer all the assets into the property and secure it? Let’s find out!

Global Inflation

Let’s face it; inflation has increased globally after the coronavirus pandemic ended. To combat inflation, it is crucial to invest wisely so that any country can escape the economic meltdown.

According to the market pundits, the inflation will remain consistent throughout 2023 and start normalizing in 2024.

A higher inflation rate means that a person has to pay more for similar goods or services because of market demand and scarcity of production.

Is it the right time to invest?

When you are a victim of high inflation, you have a choice either to accept the scenario however it is or takes action to secure your money from losing it all.

If you want to secure your purchasing power, then you need to act immediately. It has been noted that the increase in rates of products will decline once there is an investment and cash flow in the market.

The sky-rocketed prices of goods and services and the ever-increasing inflation rate mean you need to take action immediately to combat it and not lose your purchasing power.

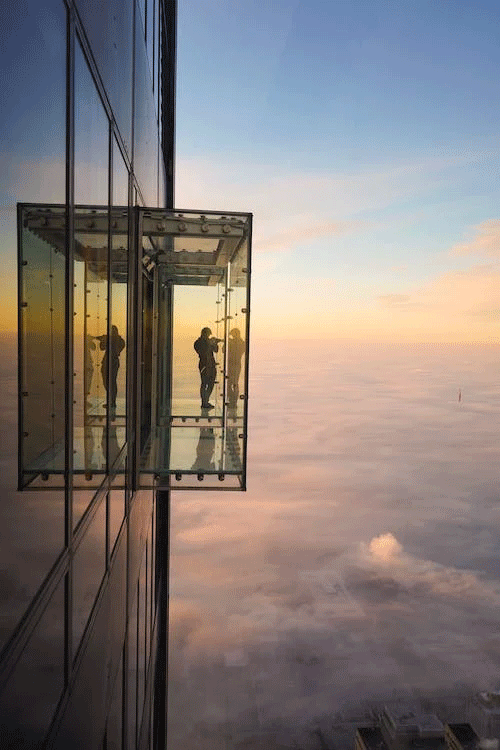

Investment in real assets

Real assets are basically physical assets having an intrinsic worth attached to them. These assets include commodities, precious metals like gold, real estate, equipment, land, and natural resources. They are included in diversified portfolios because of having a low correlation with financial assets such as bonds and stocks.

Real assets are considered more stable as compared to financial assets. Inflation may shift the currency value, and other economic factors affect the credibility of the asset. Still, real assets remain one of the strongest commodities to invest even in raising inflation.

Conclusion

Real assets are more stable than other financial assets. Inflation may shift the currency graph, but real assets remain a well-crafted investment commodity even in the sheer rising inflation times, as they have a tendency to outperform financial assets at any given time.

Also Read: Don’ts Of Interior Designing In Pakistan